There isn’t a set minimum credit score requirement for securing a personal loan, but lenders typically favor scores between 720 and 750, indicating responsible credit management and higher chances of timely repayment. However, even with a lower score, you may still qualify for a loan, albeit at a higher interest rate, resulting in increased overall payments.

It’s essential to grasp the concept of a credit score before delving into loan prerequisites. A credit score, a three-digit number, reflects your creditworthiness or the likelihood of repaying borrowed funds promptly. Consider it as a report card for your borrowing behavior. A higher score signifies a robust credit history, making you more attractive to lenders.

Here are some key points to consider:

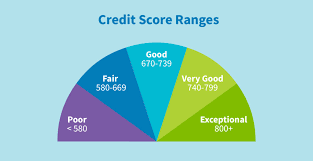

- Credit Score Range: Typically ranges from 300 to 900, with higher scores indicating better credit health.

- Credit Score Factors: Influenced by various factors including payment history, credit utilization ratio, credit history length, credit mix, and new credit inquiries.

- Credit Bureaus: Agencies like CIBIL, TransUnion, CRIF, Experian, and Equifax compile information on your credit history and produce credit reports. While factors considered are similar, the importance assigned to each can vary slightly.

- Impact of Lower Credit Score: While a lower credit score can affect personal loan options, it doesn’t render you ineligible. Lenders might offer loans with higher interest rates, leading to increased interest payments over the loan term.

- Alternative Options: If you don’t meet minimum credit score requirements, consider alternatives like NBFCs, digital lenders, peer-to-peer lending platforms, or loans against assets like gold or mutual funds for personal financing.

FAQs:

- Importance of Maintaining Minimum Credit Score: A good credit score significantly enhances loan and credit card approval chances at favorable terms, demonstrating responsible borrowing behavior.

- Minimum Credit Score vs. Preferred Range: Lenders typically have a preferred credit score range rather than a strict minimum requirement. Even with a lower score, you may still qualify for a loan, albeit with less favorable terms.

- Impact of Co-signer: Having a co-signer with a solid credit score can improve loan approval chances, especially if your score falls below the lender’s preferred range, as it supplements your application with their creditworthiness.

- Risks of Co-signing: Primary risks include potential credit score damage if the borrower defaults and becoming responsible for loan repayment.

- Safeguarding Co-signing: Co-sign only for trustworthy individuals, understand all loan terms, and discuss repayment plans thoroughly before co-signing.