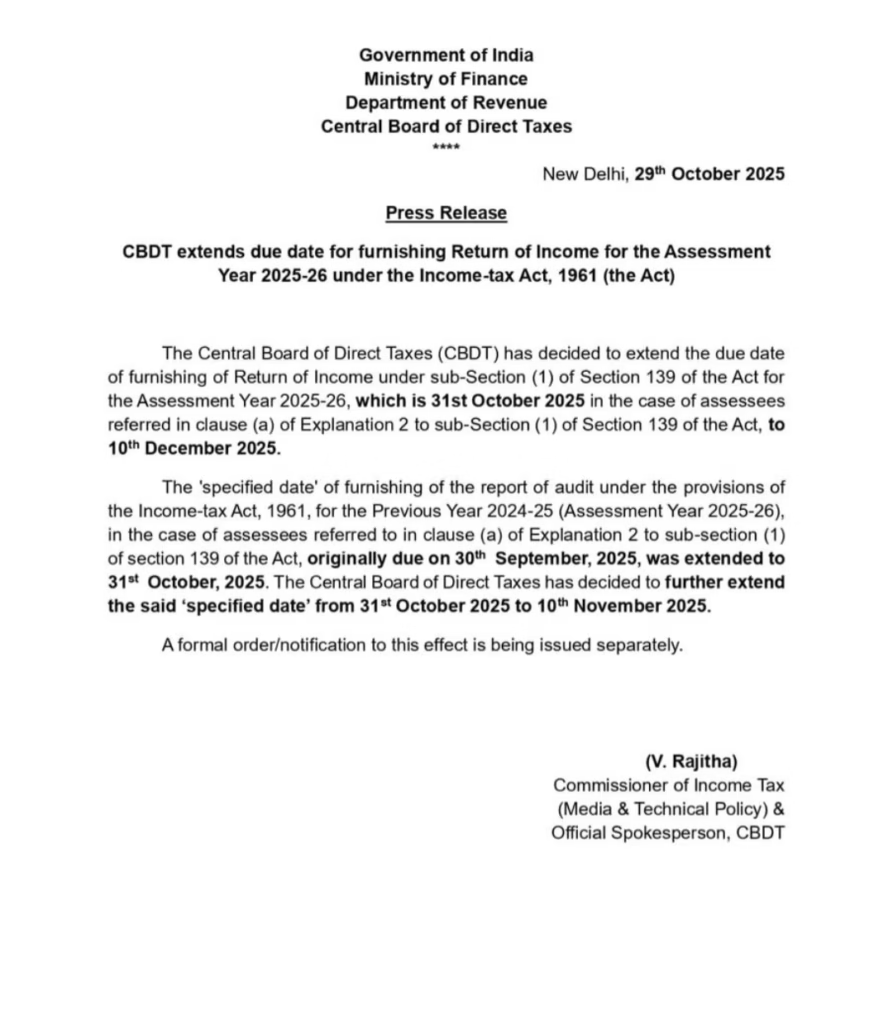

The Central Board of Direct Taxes (CBDT) has officially extended the due dates for filing Income Tax Returns (ITR) and Tax Audit Reports for the Assessment Year 2025-26, providing significant relief to taxpayers and professionals. The revised deadlines come as a timely measure, with the CBDT releasing the announcement on 29th October 2025.Revised Due Dates for FY 2024-25 / AY 2025-26.

According to the CBDT press release, assessees mandated to undergo an audit under Section 139(1) of the Income-tax Act, 1961, now have until 10th December 2025 to file their ITR, instead of the earlier deadline of 31st October 2025. Additionally, the due date for submitting the Tax Audit Report has been further extended to 10th November 2025

Key Highlights:

Income Tax Return Filing:

Extended from 31st October 2025 to 10th December 2025.

Tax Audit Report Submission:

Extended from 31st October 2025 to 10th November 2025.

Who Is Impacted by These Extensions?

These extensions are applicable to assessees referred to in clause (a) of Explanation 2 to sub-section (1) of Section 139 of the Income-tax Act, which generally covers entities and individuals who require their accounts to be audited under the Act.

Official Sources & Notification

The notification was issued by V. Rajitha, Commissioner of Income Tax (Media & Technical Policy) and official spokesperson of CBDT. The official press release is available on the Income Tax Department website and the Press Information Bureau portal. This move aims to give additional time to taxpayers and professionals, many of whom had petitioned for breather due to workload and compliance challenges.

What Taxpayers Should Do Now

Taxpayers and accountants are advised to take note of the revised deadlines to avoid late fees and ensure compliance. The CBDT has clarified that all formal notifications and detailed instructions will follow separately.